An article exclusively published this Monday on seeking alpha called 1 company a sell and 5 a buy (article).

Today, First Solar warned that it would not make earnings or revenue forecasts. The market for solar energy is so dire that the company is changing its business model to adjust for the rapid decline in solar energy prices.

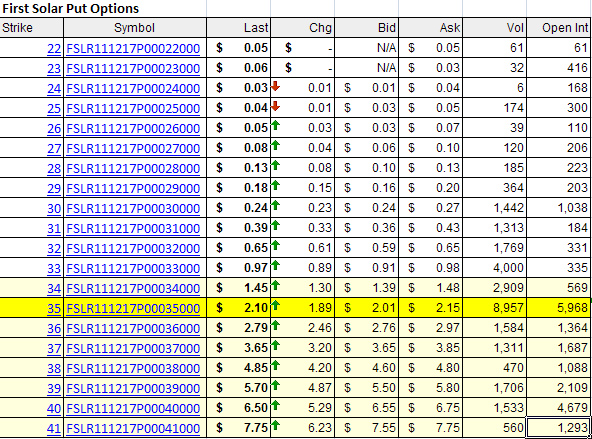

Had an investor purchased a December $35 Put, the return would have been a 12-fold return in a day:

Options can provide phenomenal returns, but an investor needs both bit of luck and skill in this area of investing. Most options expire worthless.

An investor needs to have an advantage over other participantsalpha.

First Solar's problems are big. Competitors were able to enter quite easily, tripling supply over the last three years. 80% of industry was subsidized. As the world now knows, government funding is constrained. The growth in supply to feed growing subsidies no longer applies.

In its conference call, the company said “The central learning from this experience is that open, transparent and uncapped markets cannot survive politically in an oversupplied industry with no entry barriers.”

The main risk for investors is stated here:

“We believe this translates to a levelized cost of electricity, or LCOE, of $100 to $140 a megawatt hour, or $0.10 to $0.14 a kilowatt hour in most markets. As Mark will discuss, achieving these LCOE levels without subsidies will require the First Solar to reduce its manufacturing costs, increase module efficiencies, streamline operating expense and transition its business model to deliver superior returns at much lower gross margins than in the past.”

First

Solar is now exposed to the regulatory and planning of the electricity market.

Uncertainty

is high for investors bullish on First Solar. In that climate, risk aversion

has risen, and share price will be under negative pressure.

Further reading: Crash-Proofing A $100,000 Portfolio From A European Crisis With These Companies